EXECUTIVE condominiums (ECs) were originally introduced to cater to the aspirations and needs of the so called “sandwiched” class – those whose household incomes exceed the ceiling for public housing, but are not yet able to comfortably afford a private condominium.

Currently, the monthly household income ceiling to qualify for an EC purchase is set at S$14,000, while it is S$12,000 for those purchasing the Housing and Development Board’s (HDB) Build-to-Order (BTO) flats. Over the years, 66 ECs have been successfully launched. To date, 63 of them have been completed.

However, ECs have become somewhat of a rare commodity, driving up their prices in recent years. As of the end of the fourth quarter,there were just five unsold units in launched EC developments.

The next EC launch – in Sumang Walk – is expected to be later this year. Due to the low supply, EC prices have steadily increased. A unit at Northwave was sold in January for S$864 per square foot (psf), a 15 per cent increase from the project’s median price of S$751 psf when it was launched back in July 2016.

For developers, the shortage in EC supply has accordingly pushed up land prices of EC plots to new highs. The past four EC sites have breached S$500 per square foot per plot ratio (psf ppr), with the Sumang Walk site sold at a record S$583 psf ppr to City Developments Limited (CDL) and TID Residential. Reports have estimated the breakeven price for the development to be almost S$1,000 psf.

At such prices, are ECs still a “good” buy?

Strong demand

The past few EC launches have been exceptionally well received. Hundred Palms Residences, launched in 2017, sold out all 531 of its units within a day. Rivercove Residences, launched last year, was reportedly more than 2.5 times oversubscribed and was sold out before the end of 2018. This was despite Rivercove Residences having an average selling price of S$976 psf.

Resale ECs have also been in demand. For example, there have been seven transactions since the beginning of 2019 at Esparina Residences, which reached its Minimum Occupation Period (MOP) of five years in 2018. All of them were transacted at above S$1,000 psf.

Key reasons for buying

ECs are considered subsidised housing, and hence are subject to eligibility criteria. Applicants must have a monthly household income not exceeding S$14,000 and they must purchase an EC either by forming a family nucleus or with other singles if they are at least 35 years old.

Only Singaporean couples and Singaporean/Singapore Permanent Resident couples may purchase an EC unit. Those who have bought a flat from HDB have to occupy their flat for at least five years before they may apply for an EC. The resale restrictions for ECs are partially lifted after five years (resale is allowed to Singaporean and Singaporean and Permanent Resident buyers) and fully lifted after 10 years.

EC purchasers are also subject to the Mortgage Servicing Ratio (MSR) which limits them to using 30 per cent of their monthly income to service a housing loan.

These restrictions effectively limit the prices of ECs sold by developers. Because of the income ceiling and MSR, developers have to be very realistic about the prices they set. Overly optimistic prices would price buyers out of the market.

Hence, we believe that ECs will continue to be affordably priced as long as the ownership restrictions are in place. In addition, first time buyers of ECs can enjoy up to S$30,000 in Central Provident Fund (CPF) grants, depending on their income. This further enhances the affordability of ECs.

Because of these eligibility criteria, ECs are typically priced at a discount to private condominiums despite being essentially the same product.

Private properties sold by developers in Tampines (District 18), Punggol, Sengkang and Serangoon Gardens (District 19) and Sembawang and Yishun (District 27) have median prices of S$1,325 psf, S$1,475 psf and S$1,257 psf in 2019 respectively.

Even though the upcoming EC developments in the same districts – Tampines Avenue 10, Sumang Walk, Anchorvale Crescent and Canberra Link are expected to be launched at above S$1,000 psf, they are still at an attractive discount to the surrounding private developments.

This means EC buyers have an immediate price advantage over private condominium buyers as they are buying a product that has a similar look and feel of a mass market condominium, but at a cheaper price since ECs come with full condominium facilities and have the same level of privacy and finishes one would typically expect in a private condominium.

After factoring in the five- and 10-year resale restrictions, and depending on the state of the market at the relevant point in time, ECs could have more potential for capital gain than private condominiums.

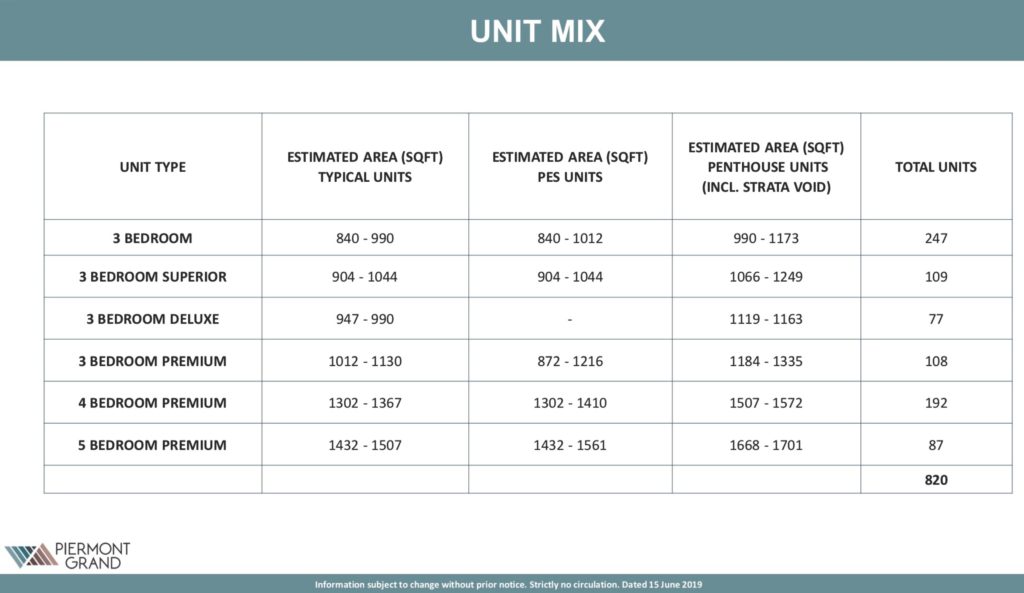

Some buyers also prefer ECs because of the living environment. Because of the eligibility criteria, ECs are targeted solely at owner occupiers, and mainly comprise three and four bedroom units.

This is in contrast to private condominiums which usually cater to investors by having one bedroom and two bedroom units. Hence, in an EC environment, the majority of the residents are likely to be local families whereas in a private condominium, it is likely to be quite diverse.

Still value buys

The upcoming EC developments, while expected to be priced higher, are still excellent value, especially taking into consideration their potential for growth. The Sumang Walk and Anchorvale Crescent sites will benefit from the Punggol Digital District, a key growth cluster in the North East Region envisioned to create up to 28,000 new jobs.

The Canberra Link development is near the upcoming Canberra MRT station and Woodlands Regional Centre. The Tampines Avenue 10 development stands to gain from the upcoming Changi Terminal 5 and already established Tampines Regional Centre.

Executive Condominiums are undeniably still a value proposition today and a great option for eligible purchasers.